The United States Senate has passed a long-awaited spending bill. The Inflation Reduction Act aims to tackle climate change, healthcare, taxes, and more. In it are huge changes to the EV tax credit, including the fact that it can be applied at the point of sale instead of at tax time. But it also makes big changes to which cars do and do not get a credit, so let’s get into it.

On August 7, the Senate passed the Inflation Reduction Act of 2022. It comes after Senators spent the weekend voting on amendments to the monster 755-page legislation. The bill now heads to the House of Representatives, where it’s expected to pass. Then it lands on President Joe Biden’s desk. A statement from President Biden indicates that he intends on signing it, and that could happen later this week.

[Author’s Note: You can read the full legislation linked here or in mentions of the Act.]

As Electrek reports, the bill–a scaled down version of the Build Back Better Act with a new name–authorizes $369 billion in spending on fighting climate change, down from $550 billion. That $369 billion breaks down, in part, like this (from Electrek):

This climate spending includes $60 billion for solar panel and wind turbine manufacturing (and $30 billion in credits for new projects), $60 billion for disadvantaged communities that bear the brunt of climate impacts, $27 billion for clean tech R&D, $20 billion to reduce agricultural emissions, $5 billion for forest conservation, and $4 billion for drought funding in Western states.

There are also credits for home upgrades like rooftop solar, battery packs, heat pumps, induction stoves, and more. But I have a feeling that you’re here because you’re interested in one of the other big parts of the bill: The EV tax credit.

The short version is that if the bill gets signed into law the $7,500 EV tax credit would be extended an entire decade. Used electric cars priced $25,000 or less would also be eligible for an EV tax credit of up to $4,000. However, there are a lot of caveats and changes. Here’s how we got here in the first place.

Currently, the U.S. Department of Energy states:

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to $7,500. The credit amount will vary based on the capacity of the battery used to power the vehicle. State and/or local incentives may also apply.

This is how buying an EV or plug-in hybrid has been for a while. But it’s not really as simple as the government’s blurb makes it out to be.

Currently, if you buy an electric car, you still have to pay full price. Come tax time, you can claim a tax credit of up to $7,500. “Up to” is the term to pay attention to, there. The amount depends on two main factors: how much tax money you owe and the size of the battery in the vehicle.

Say that you buy a Nissan Leaf.

It’s a vehicle that’s currently eligible for the full $7,500. However, let’s say that you owe Uncle Sam only $1,000 at tax time. Well, under how the credit is currently structured, your credit is just $1,000. The credit isn’t refundable, so you won’t be getting $6,500 in the bank. And it can’t be applied to next year’s taxes.

One of the biggest EV credit changes proposed in the Inflation Reduction Act is that credits are applied at the point of sale. That means that you don’t have to pay full price then wait until tax time to get some or all of the credit. Instead, the credit is applied at the point of sale, which means that you pay a lower upfront price.

Another big change is the removal of the manufacturer production cap. Currently, the full credits can be applied to only 200,000 cars per manufacturer. That’s a cap that GM, Tesla, and Toyota have exceeded, with other manufacturers also on their way. After the cap is hit, the credits to customers are then reduced by 50 percent every six months until they’re phased out. The Department of Energy notes that GM’s EVs haven’t been eligible for the tax credit for over two years.

With the Inflation Reduction Act, the cap is lifted, allowing full credits for eligible vehicles from popular automakers.

There is a catch to that, and it’s that vehicles now have caps on their MSRP. That’s up to $55,000 for cars and up to $80,000 for SUVs and trucks, Above t hose, and there’s no credit. There are additional requirements that eligible vehicles must be built in North America. And as CNBC notes, how an EV’s battery is made will also impact if it’s eligible for a credit:

As written, the law requires that 40% of battery components be sourced from factories in the U.S. or its free-trade agreement partners; that batteries be U.S. made by 2029; and that Chinese components and minerals be phased out beginning in 2024.

Right now, it is not clear if any U.S. battery plant can meet the law’s requirements.

Based on these new rules, manufacturers with currently phased-out credits may now get the full up-to $7,500 credit. That means that, depending on how those batteries are made, you could get up to $7,500 on the hood for a Chevrolet Bolt or a Tesla Model 3. However, vehicles like a Tesla Model S, Model X, and higher trims of the Model 3 will be ineligible because of their MSRP.

And because of the requirement that eligible vehicles have to be built in North America, a large number of vehicles that were eligible before will not be eligible in the future. Those vehicles would include the Toyota Prius Prime, Hyundai Ioniq 5, BMW i4, Subaru Crosstrek Hybrid, Volvo S90 Recharge, and many more.

A Reddit user has compiled a list of what this would look like, and a bunch of vehicles may be losing tax credits. And the list isn’t accounting for how the batteries are made in otherwise eligible vehicles.

The requirements do not stop there. In addition to the vehicle MSRP caps there is also an income cap. That cap is $150,000 for a Single-filing taxpayer and $300,000 for those filing jointly. For used vehicles, the cap is $75,000 and $150,000, respectively.

If signed into law, most provisions go into effect on January 1, 2023. However, one important provision — the location of a vehicle’s assembly — goes into effect after signing. That means if you want to take advantage of current tax credits on a vehicle built outside of North America, you’ll want to get a purchase agreement as soon as possible.

Being able to take advantage of the tax credit right away is a huge win. Now, EVs can be more affordable for more buyers.

For example, with the Bolt now having a starting price of $26,595, this means that you may be able to score one for under $20,000. Another win is allowing popular brands to take advantage of credits. However, a surprising number of other vehicles will no longer be eligible for tax credits. Some of those vehicles aren’t even luxury vehicles. Still, this seems to be a win overall, but we’ll have to wait a little longer for further details on how this will unravel.

I wish they would have just let the current EV credit play out, but they overwrote it with the new. I was looking at getting an EV next (none of the current models are something I want) from a manufacturer who hadn’t yet reached 200,000 vehicles sold (like Polestar). Under the new legislation, none of the new Polestars coming will meet the criteria. Under the old bill, they all would have qualified. Same situation for most of the other manufacturers I was looking at. I’ve been waiting a long time to get an EV and the tax credit had always been part of my plan to afford one. Losing it sucks. 🙁

Goal: Increase consumer demand for electric vehicles.

Secondary goal: Decrease purchase price for these vehicles

Tertiary goal: Make EVs more affordable to the middle class

What we did: Make it impossible to qualify for tax refunds for these vehicles

What we did: Make it more expensive for manufacturers to build these vehicles

What we did: Make the process so hard to understand that middle class buyers won’t even consider an EV.

What we did: Take EVs that currently qualify for tax credits off the list.

Zero goals achieved. In fact, they made it WORSE. Yet they celebrate like they accomplished something.

This is why our lawmakers suck and all need to be replaced.

This is not true at all. By capping the price we incentivize the manufacturers to drive prices down–this puts them in the middle class.

By using non Chinese components we don’t support dictatorships, we increase the likelihood of union jobs, and make a better, bigger middle class that can buy these things. I don’t know if you’ve been paying attention, but labor costs haven’t been the problem. Companies have been raising prices for no real reason, NOT raising labor costs much, if at all, AND turning int RECORD BREAKING profits. Quite a nice scam!

I personally want to make sure that EV production is happening here given current global politics.

Lastly, I’m sorry, but, um, if US tax dollars (or the non collection of them) is going to be involved, then YES IT SHOULD BE FOR AMERICAN CARS/AMERICAN COMPONMENTS. Manufacturers can build a factory here like they do in most cases anyway.

MOST GOALS ACHIEVED!

That still drives up the cost. It’s great to move all that back to America, but it does not make it cheaper and it does not incentivize manufacturers to reduce prices.

The statement that companies have been raising prices for no real reason has no basis in reality. The law of supply and demand is absolute in the marketplace. When a car has a waiting list because the manufacturer can’t deliver it due to parts availability problems, prices will be high.

Insisting that EV batteries be made in the USA when the capability of manufacturing those batteries in the USA doesn’t exist is not going to drive down prices. The idea that the government can wave it’s hand and make prices go down is absurd.

In general as a tax paying citizen I find tax credits as a very inefficient use of taxpayer money. But politicians love it. Insert heavy sigh.

it is, unfortunately, the only politically viable approach. I would prefer better, but I’m not going to complain much. If in a few years we see it’s not working, then we have data to argue for better alternatives.

Two questions:

(1) Do PHEV/EVs purchased after the bill is signed into law but before the end of the calendar year still qualify for the old credit, assuming they were assembled in North America?

(2) If the car wasn’t assembled in North America, is a signed build order plus an order deposit (placed before the bill is signed into law) sufficient to get the old tax credit?

1. They should qualify for the new credit if they meet all the US manufacturing criteria, but it goes a bit beyond simply US assembly. The lithium sourcing is a big sticking point, given that it must be sourced from the US or a free trade partner.

2. Probably, but no one seems to be certain. I’m hoping, because that is where I am with things.

1. Gotcha. I hear you on the battery sourcing requirements—my understanding was that those requirements are dependent on additional guidance to be provided by the end of the year. If I bought a NA-assembled vehicle say next month after the act is signed but before the battery guidance is provided, I wasn’t sure if the old credit rules (excepting the assembly provision) would still be in force or if the new credit provisions would apply. It’s rather complex…

2. Yep, a lot of people seem to be in the same boat. Lots of conflicting opinions on the internet…

You’re right. I misremembered which clauses hit which other clauses. The battery sourcing goes into effect as soon as there is guidance, which must be provided before the end of the year. And if you order something before that point but after the bill is enacted, you will need to take delivery before said guidance, as there is no transition rule except for the one for orders pre-enactment.

The income caps are seriously problematic. The new car one isn’t horrible but the used car one is hilariously out of whack for anyone living in a higher cost of living area. Everywhere I’ve lived, $75k is not enough to buy a new EV, even with a subsidy. Oh but apparently you are too wealthy to get credit for a used EV? Also the credits go quite a ways into the future but the income, amounts and price limits don’t have anything to keep them relevant. On that note, $7500 was worth a lot more in 2010 than it is today!

Well $300/150k in West Virginia, and you’ll live like a king. Other places, you are pretty much “middle class”.

I mean this will probably slow my adoption of an EV. I was planning to get a PHEV with the $7500 rebate. If there was more vehicle supply out there, I might grab one now, but they also aren’t cheap so I don’t just want whatever 2 vehicles are on the lot.

Without the credit, the numbers need to work on their own, which becomes a tougher value proposition. I’m not buying a full EV for one car until charging is wider spread and reliable. We go out into the middle of nowhere quite a bit, and charging isn’t viable there and don’t expect it to be any time soon.

for married people I think it’s fine for cars that shouldn’t be that expensive to begin with. If you want the luxury EV and can afford it, by all means, get it. But I don’t think middle class taxpayer money should subsidize it.

My question is this: Now that the Bolt is eligible for the full $7500, is GM going to keep the plan in place to lower the MSRP by $5900 for the 2023 model year?

They already have the 2023 configurator up, so I suspect they will keep the lower MSRP, but supplies will likely be constrained.

Best explanatory article on this topic I’ve seen by far, thank you for writing it. Articles I’ve read elsewhere have left

me with more questions than answers, but this is pretty comprehensive. My only major question is: is the tax credit now refundable? If I take a $7,500 point-of-sale credit in September but then it turns out next April I only owed $1,000 in taxes to begin with, am I on the hook for $6,500?

I’m mostly OK with the protectionist requirements in the tax credit. Automakers will adjust. The US wants to be a big player in battery manufacturing, and this will probably be the kick in the ass the industry needs to make that happen. It’ll be weird for a few years, but it’ll sort itself out. I’d rather have my batteries made here than in most of the places they’re made now, because at least here we kinda-sorta have worker and environmental protections that should mitigate how exploitative and rapacious battery manufacturing is. Also, there are so many jobs and so much money to be made in batteries in the near future that if America wants to maintain its position in the global power structure—which is a given within the US government—we need to get in on this. We can’t let it be like what happened with solar panel manufacturing.

What I’m not cool with is the price cap for trucks and SUVs being $80,000, whereas for cars it’s $55,000. Do we really need to tilt the playing field even more in favor of larger, more dangerous, less efficient, more resource-intensive vehicles? (Not to mention ones that are less fun to drive, but that’s beside the point.) What exactly is the motivation there? What were the writers of the bill trying to achieve? Because I only see negative consequences from that little wrinkle.

I’d also love to have seen the full credit applied to used vehicles. I mean, why the hell not? They seem to want middle-class folks to be the beneficiaries of this credit (hence the income cap) but they’re not going to give those same people as much of a break on used cars? Buying used is better for the environment as well, since you’re not requiring someone to build a whole car just for you. Heck, we should be encouraging people to buy used. This does the opposite.

Still, it’s a good bill overall that’s going to help usher in a lot of positive changes. It’s also great for me and my industry, of course. If you work in any kind of clean-energy field you have to be cheering this on.

“My only major question is: is the tax credit now refundable? If I take a $7,500 point-of-sale credit in September but then it turns out next April I only owed $1,000 in taxes to begin with, am I on the hook for $6,500?”

I think it is NON-refundable… you will be on the hook to pay $6500. I expect dealers may not be perfectly clear about that customers. In fact, I think they should remove that “point of sale” thing unless they make the credit refundable.

I am not a lawyer, but I believe in all the striking of paragraphs and changing to add the income limits and add the ability to take it as a rebate at point of sale, they have also changed the part that placed it as a non-refundable credit. However, the tax code is complex, so I do not know for sure whether all the references and verbiage make it refundable.

That said, people far more educated than I am have analyzed it and say it will be refundable, so I am inclined to believe them.

THIS

It is a tax credit. Means you need to be paying an amount of tax equal to a credit. Means the 7500 amount of tax requires a salary and lifestyle that is incomprehensible to me.

It seems in the joyous moment a lot of money is being spent that won’t be credited.

There are refundable and non-refundable credits. By all accounts from people with more knowledge on the subject this changes the credit to refundable, so it can reduce your tax liability into the negative.

The current credit is non-refundable, so you do need to have tax liability high enough to use it. With the standard deduction, that equates to a salary between 65k and 70k to take the full 7500 (maybe a little more or less, depending on tax situation–probably closer to 70-75k if you contribute to your retirement and pay for health insurance).

I agree. Along with getting rid of the CAFE differences for cars vs bigger vehicles, it should be one requirement for both. I would be ok with them increasing the one for cars and decreasing the price requirement on larger vehicles and just having one average cost limit.

But, also, nitpicking on things like that is also how it becomes to the point where nothing gets done…

All the more knowledgeable sources that have done deep dives say the credit is now refundable, which is a good change. The sourcing part that will be difficult is the minerals for batteries. But I am sure someone will find a way to route lithium in such a way as to get it from a country with a free trade agreement and it’ll all be fine.

Excellent news, that’s how it should be.

It figures that I could finally afford an EV and have it on order; however it is foreign so I am screwed. That tax credit would have really helped this year.

There is a clause in the bill that allows you to keep the old tax credit if you have a “binding contract to purchase” before it is enacted. I don’t know how binding it needs to be, though. Non-refundable deposit isn’t quite the same as the ability to force you to go through with the purchase, but I think that level of binding contract before delivery is uncommon.

My reading of the act is that a signed agreement between the customer and the manufacturer (via a dealer or direct) is a binding contract to purchase – you have plunked down earnest money, and the mfr committed to build a car to your spec. If either party terminates the agreement there won’t be a sale, and so the point of the old EV credit becomes moot.

I’m in the same boat, in that the ETA for delivery is Jan ’23 even though the “binding contract” has been signed long ago. Recall that the intent of the credit is to encourage “greenness” (or used to be, before Manchin tweaked it), and it would suck to miss out just because there is a delay in transit, or the dealer’s point-of-sale is out of service and you can’t complete the transaction before the arbitrary date of 12/31/22.

After looking more into what the bill contains, this might not be as good as it initially sounds. Since the battery components will have to be made in North America and US trade partners, that means automakers will no longer be able to get lithium from China after 2023 if they want to qualify for the discount. Normally I would be okay with that, but since most lithium is currently sourced from China automakers will have to make serious changes in the way they source their materials before 2029 when all the sourcing requirements go into effect. This has the possibility to drive up the price of lithium to a point that offsets the $7500 tax credit. It could also end up working out and reducing our dependence on China, but there is certainly a risk of this backfiring. In fact, since so much of the world’s lithium comes out of China, no new EV would be eligible for the tax credit with all the restrictions in place, which is concerning. I’m less concerned about the requirement for assembly in North America since most automakers already have assembly plants here, but many cheaper EVs like the Hyundai E-Kona, Mini Cooper SE, and Kia EV6 are not currently eligible. For luxury automakers in particular like BMW and Mercedes, the 55k price cap for sedans and hatchbacks means that they might not even bother with trying to qualify since most of their vehicles will be out of range of the tax credit. I think it’s a little stupid that there is a difference between the price cap sedans/hatchbacks and SUVs/trucks, IMO they should all be at $80k. The tax credits go into effect after Dec 31st, so if you’re thinking of buying a new EV you might want to do it soon depending on the model.

Lithium production by Country, 2021, in Tonnes (:

Australia – 55,000

Chile – 26,000

China – 14,000

Argentina – 6,200

Brazil – 1,500

Pretty sure China can be replaced for US vehicles…

Oh wow, I hadn’t seen that! Articles I was reading were implying Chinese lithium would be a bigger issue.

That’s for the original ‘ore’ though. My understanding is, China has almost all of the Lithium refining capacity, so almost all of it still goes through China. That’s been their gig the past few decades – they don’t have the raw materials, but, they make their refining capabilities so attractive that everyone sends stuff there for refining.

A large lithium deposit has been found under the Salton Sea and a mining operation is currently going up.

Nearly every EV made currently would be ineligible for the new credit due to the battery pack restrictions. Now, there are plants coming soon(ish) that could bring back the credits for those companies, but they are not currently online. Arstechnica did a great article on this aspect of the bill.

https://arstechnica.com/cars/2022/08/its-possible-no-electric-vehicles-will-qualify-for-the-new-tax-credit/

Battery plants are coming, but they aren’t ready, yet.

I don’t know, I kind of wonder if this sort of reduces the incentive for manufacturers to find ways to reduce the cost of building electric cars – the government’s kicking in some subsidies, so why fret about another few grand the customer isn’t going to see anyway, etc.

Also, they’ve already banned new ICE cars effective ca 2035, automakers either have to have an all electric range in 12-13 years, or just go out of business and liquidate their assets, its a mandate, that’s how mandates work, not really sure why any more incentives are even needed, its going to happen because its already required to happen. You’ll either buy an electric car or no car in the very near future, yeah, I get it, people want it to happen RTFM instead of over the next decade, but, given product development cycles, that’s a very short and reasonable timeline, just wait it out.

Hey would you believe that, the US government is promoting US manufacturing.

After several decades having the US government promote Chinese manufacturing it’s an interesting change.

The really exiting part about this IMO is that there is an up to $4k credit on USED cars under $25k, which means that a $10k used Nissan Leaf is now $6k, which makes it significantly cheaper than the competition.

You forgot the up to part. On the bright side this shouldn’t cost as much as budgeted with all the requirements.

After looking into it, the tax credit is for either $4k or 30% of the list price, whichever is less. That would still make a used Leaf cost $7k as opposed to $10k, so it’s still pretty good, just not quite as good as I thought. It’s also only applicable if you make less than $150k as a joint filer, $112,500 as a head of household, or $75k as an individual. I’m not quite sure how that would work for hourly workers, but either way it’s a substantially lower income cap than for a new EV.

Assuming that’s after deductions a single person making less than $32 an hour should easily qualify. And a single earner for a family ~$60/hr that safely encompasses lower and middle class people.

Except, doesn’t the NA content requirement eliminate it?

There aren’t any special requirements for used vehicles thankfully, only new vehicles.

Unfortunately the supply of used cars is relatively inelastic (as we’ve seen recently) so prices are likely to go up in response to the credit. The new car credit at least factors into the manufacturers calculations about how many units can be profitably manufactured and sold when they are designing manufacturing plant output (assuming raw materials isn’t the limiting factor like it has been for some cars).

Only if you owe the government $4K in taxes. If you are getting a tax refund already, you get nothing.

I am lucky that I got my Polestar 2 on December 2021 and was able to take full advantage of the tax credit. Because of their manufacturing location, the tax credit will be gone soon. For my 21 Chevy Bolt, I didn’t have a tax credit but GM applied a lot of discounts, more than the tax credit, using GM employee pricing plus Costco discounts, etc, it was so cheap at the time. I am still waiting for the battery replacement (I have the software fix for now). I just installed solar too, and there is a 30% tax rebate coming soon for next year.

The Chevy Bolt could be the Beetle of the EV chapter but the damn recall made it worse and its scheduled to go out of production somewhere after 2024, they may keep it longer now with the new tax credits to take advantage of new customers under GM umbrella

Spending your way out of inflation makes as much sense as fucking until you get your virginity back.

https://www.crfb.org/blogs/whats-inflation-reduction-act

The CBO estimates this would actually reduce the deficit. Seems that it has built in revenue streams to offset its cost, so it can’t really be called spending your way out of inflation.

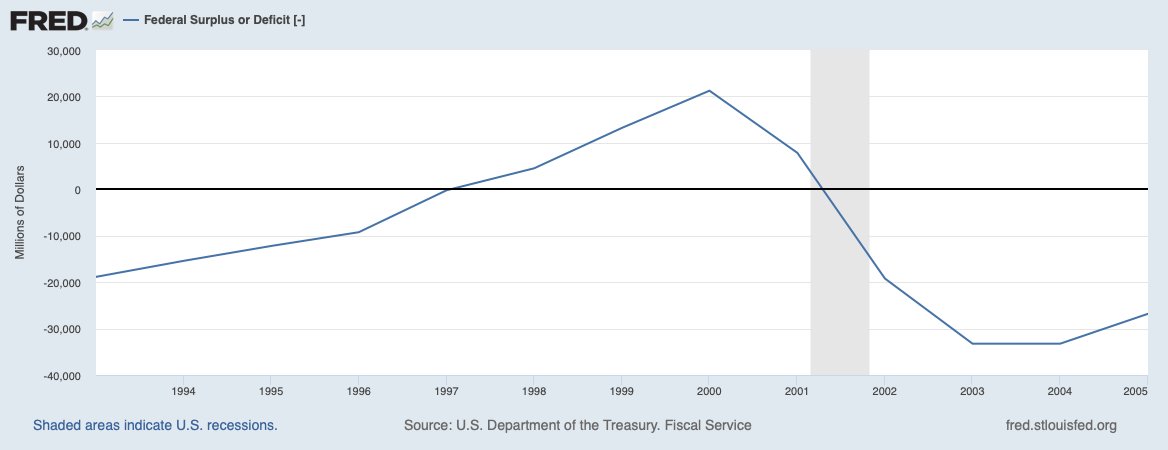

Yeah the CBO didn’t really say that. It did say it might not increase inflation any higher. And their 10 year guessing has never been accurate. Back when Clinton was president his budget actually was supposed to eliminate the deficit with increased spending but offset by tax increases. It never came close. This is just government trying the same thing because people believe this crap.

Well it WAS coming down and then W got elected and decided that why have a surplus when we could have lower taxes for rich people? (and that was even before the magical adventures in the middle east that ended up costing trillions of dollars).

Leaving aside that the whole deficit debate is mostly stupid. Since the government isn’t growing old and retiring the only thing that matters is the trajectory of the cost of servicing debts relative to the size of the economy.

Nah. The big passed through budget reconciliation, which requires a CBO finding that it reduces the long-term deficit.

Also, during the Clinton administration, the government did fully eliminate the deficit for several years:

https://www.cbo.gov/publication/58366

Seems the CBO did say it would result in a net decrease of the deficit, which is what I said. What the CBO DOESN’T generally do is determine the effects on inflation. I included the link the the CRFB earlier to show an outside analysis of the CBO’s estimates, and they are the ones who say it is likely to reduce inflationary pressures.

But sorry that I give the thorough analysis more weight than an online comment, I guess?

It’s estimated that the other changes included in the Act (the corporate tax, for example) will generate enough revenue to offset the spending, and hopefully ease inflation.

Of course, we’ll see what happens in practice!

In practice, dealerships will always take the maximum credit they can to make the deal work, then leave it up to the buyer to hash out any problems at tax time.

“Oh, only our smaller battery pack qualifies as US made enough? Gee, sorry about you owing the government thousands of dollars, but how about a free tire rotation to atone for the oversight?”

I’m still waiting for a rational explanation of how taxes offset inflation unless the government is literally setting that money on fire to remove it entirely from circulation. However, that implies that they haven’t already spent far more than they are taking in taxes – which they have and why we’re running at a deficit. The way government does math makes Bezos’ taxes look like child play.

Man that is so provincial. To become a virgin again all you have to do is self identify as a virgin.

I think there’s usually some sort of ceremony involved, and also one of those rings like the Jonas Brothers had

Yep. Intentional or not, Mercedes gets it right. “The Inflation Reduction Act aims to tackle climate change, healthcare, taxes, and more.” Notice inflation isn’t on that list… it’s just in the name.

I’m sure willing to give it a try over and over until it works out.

Here’s what goes into effect when:

(k) EFFECTIVE DATES.—

(1) IN GENERAL.—Except as provided in paragraphs (2), (3), (4), and (5), the amendments made by this section shall apply to vehicles placed in service after December 31, 2022.

(2) FINAL ASSEMBLY.—The amendments made by subsection (b) shall apply to vehicles sold after the date of enactment of this Act.

(3) PER VEHICLE DOLLAR LIMITATION AND RELATED REQUIREMENTS.—The amendments made by subsections (a) and (e) shall apply to vehicles placed in service after the date on which the proposed guidance described in paragraph (3)(B) of section 30D(e) of the Internal Revenue Code of 1986 (as added by subsection (e)) is issued by the Secretary of the Treasury (or the Secretary’s delegate).

(4) TRANSFER OF CREDIT.—The amendments made by subsection (g) shall apply to vehicles placed in service after December 31, 2023.

(5) ELIMINATION OF MANUFACTURER LIMITATION.—The amendment made by subsection (d) shall apply to vehicles sold after December 31, 2022.

(l) TRANSITION RULE.—Solely for purposes of the application of section 30D of the Internal Revenue Code 19 of 1986, in the case of a taxpayer that—

(1) after December 31, 2021, and before the date of enactment of this Act, purchased, or entered into a written binding contract to purchase, a new qualified plug-in electric drive motor vehicle (as defined in section 30D(d)(1) of the Internal Revenue 25 403 ERN22410 5DM S.L.C. Code of 1986, as in effect on the day before the date of enactment of this Act), and (2) placed such vehicle in service on or after the date of enactment of this Act, such taxpayer may elect (at such time, and in such form and manner, as the Secretary of the Treasury, or the Secretary’s delegate, may prescribe) to treat such vehicle as having been placed in service on the day before the date of enactment of this Act.

The “binding contract” (I have a non-refundable deposit, but is that a binding contract?) and “at such time, and in such form and manner, as the Secretary of the Treasury, or the Secretary’s delegate, may prescribe” make the ability to get the old credit on previously ordered vehicles a little sketchy, too. It seems like it would have been a lot easier for the IRS and buyers to just know the sale had to take place before some specific date to count.

“However, let’s say that you owe Uncle Sam only $1,000 at tax time.” Careful here. A lot of people misinterpret this and the “non-refundable” to mean fewer people are eligible under the current plan than are. If your total tax burden is only $1000, you only get $1000 knocked off of it. But if you’ve been paying all year (as most of us with paychecks do), you are still eligible to get your overpayment back.

If I would owe $8600 in total, and have paid $8600 over the course of the year, I’d be eligible for the full credit and would get back $7500 dollars of overpaid taxes.

I was going to post the same.

Thanks for clarifying, I was wondering how this worked out.

plus if you weirdly did get into this circumstance, see an accountant, they will ensure you get the full credit by figuring out how to adjust other things. There’s a thousand ways to skin these kinds of cats.