Tesla has lowered prices of its vehicles seemingly across the board in an unannounced late night move, with prices dropping as much as 23% for a Tesla Model Y Performance and 6.4% for a Tesla Model 3 RWD. This move seemingly was done to take advantage of a procedural move by the IRS, which we wrote about earlier, that makes it possible to get the full $7,500 tax credit on a Tesla for a few weeks. Additionally, Tesla also dropped prices on other vehicles in the lineup, even though it may not qualify for tax credits.

“Honestly, I’m not even sure what to make of these changes,” Ryan Levenson, who owns the EV Cannonball Run record in a Tesla and makes videos about EVs, told me in a DM. “A Part of me is excited more people can afford to buy a Tesla and part of me is disappointed for recent customers who had to pay more to buy a car just a couple days ago, especially anyone who purchased in the last 12 days.”

Why is this happening?

“If I were to guess, this is an effort to qualify for the tax incentives while getting the largest possible quantity of new cars on the road in 2023,” said Levenson.

The Inflation Reduction Act, which passed last year, fundamentally altered the way the government gives credits for buying an electric vehicle. Prior to the law, the government’s initial tax credit had no price or income cap but was limited to 200,000 vehicles per automaker. The new law removes the 200,000 limit but puts additional requirements (like sourcing of battery materials) on automakers to qualify for the full $7,500. We have a write-up explaining this you can read.

Because of a debate over interpretation of the law, the IRS has delayed offering a final ruling on certain aspects until March 31st of this year. The income levels requirement is in place (meaning you need to make $150,000 or less filing solo or $300,000 filing jointly) and, more importantly, the price limit of a vehicle also is in place. A vehicle has to be under $55,000 if it’s a regular passenger vehicle and $80,000 if it’s an “SUV.” This is important.

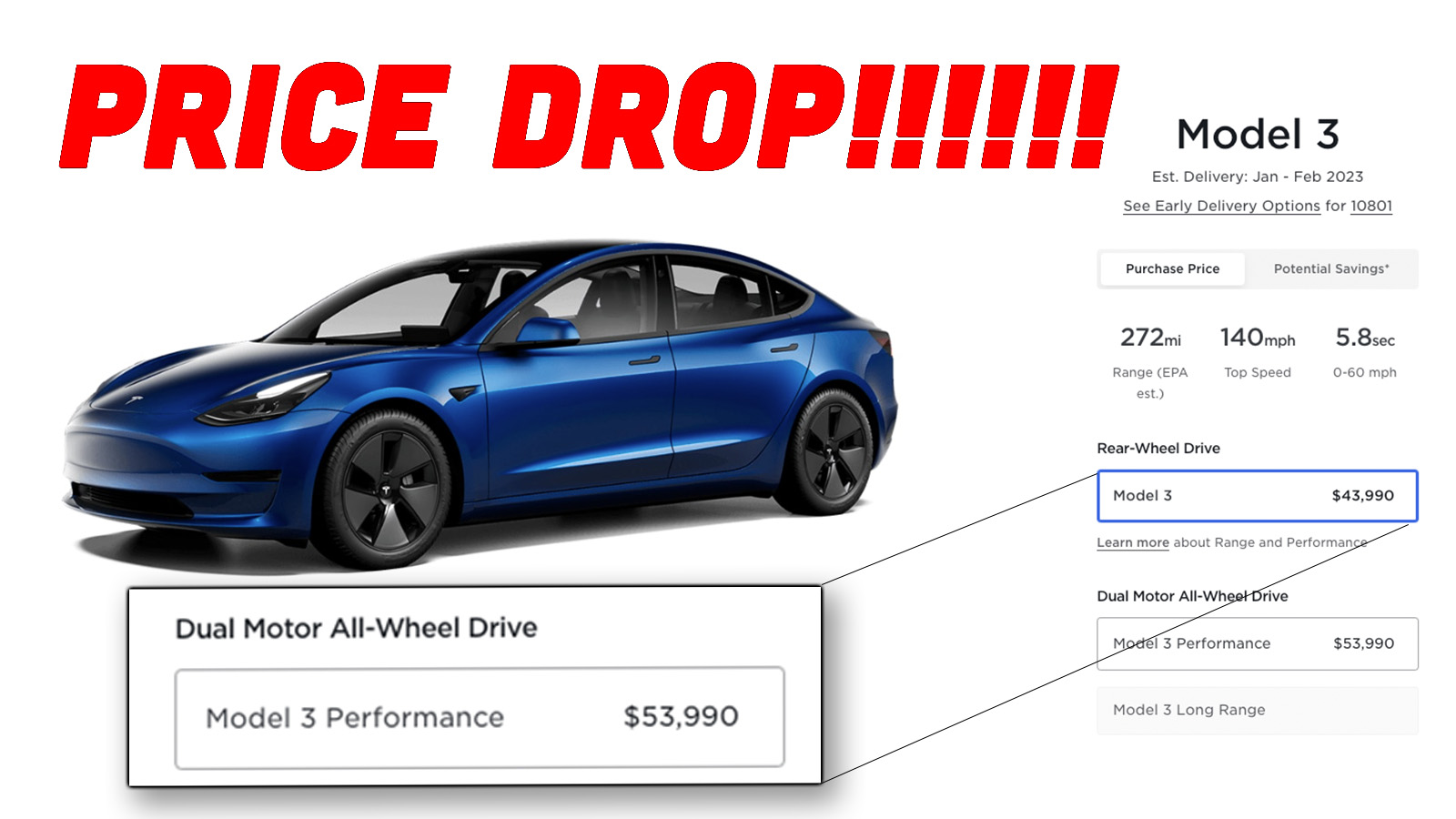

Up until this evening, a Model 3 Performance cost $63,900 which meant it didn’t qualify. It’s now listed as $53,990, which means it does potentially qualify. If you meet the other requirements you could, in theory, buy a Model 3 Performance for $46,490. The base Model 3 was also dropped to $43,990, which means you can potentially get into a Model 3 for $36,490.

The same can be said for the Model Y Long Range, which was dropped to $52,990 from $65,990. That vehicle, too, should qualify. The Model Y Performance has also seen a massive price drop (at 23%, likely the biggest) to $56,990, though this probably keeps it out of range for a federal tax credit.

Price drops aren’t just limited to lower-end Teslas, as others have noted:

BREAKING: @Tesla has reduced the price of the Model S/X in the US:

• Model S: $94,990 (from $104,990, 9.5% drop)

• Model S Plaid: $114,990 (from $135,990, 15.4% drop)

• Model X: $109,990 (from $120,990, 9.1% drop)

• Model X Plaid: $119,990 (from $138,990, 13.7% drop) pic.twitter.com/uKeRxwGcvT— Sawyer Merritt (@SawyerMerritt) January 13, 2023

In addition to keeping ahead of the quirk in federal tax law, this is likely also to be a boon for Tesla when the company needs to change the narrative from stories about CEO Elon Musk only caring about Twitter now and crashes involving cars with semi-automated driving systems.

While it’s possible that Musk is doing this out of the goodness of his heart, the reality for the company is that it’s been losing market share as brands like Ford, Kia, Volvo, Polestar, and others offer comparable vehicles. According to a report from S&P Global Mobility discussed in this CNBC article, Tesla’s share of the EV market has dropped in the United States from 79% in 2020 to 65% in the third quarter of last year. The firm predicts that Tesla’s share will drop to 20% by 2025. This same issue is happening around the world, with Tesla dropping prices in China just days ago. Some have also pointed out the discovery of rare earth metals in Sweden, but the timing of that is questionable.

“Price changes of this magnitude are unprecedented and while it’ll surely increase demand this quarter, in my opinion it also has the potential to really hurt brand loyalty,” said Levenson. “Whatever it is, I don’t think any other OEM can compete with this, Tesla had the largest margins on their cars in the industry and probably still will after this which is potentially the most insane part.”

It’s important to point out that the most popular interpretation of the law is that the vehicles need to be delivered by March 31st, so you can’t just order one and file it on your taxes later. This is perhaps why Tesla says delivery is estimated between January – March 2023 on their website.

Support our mission of championing car culture by becoming an Official Autopian Member.

The Hybrid Wankel Rotary-Powered Mazda MX-30 R-EV Is Finally Here. Here’s How It Works

Tesla Owners Are Incredibly Unhappy About Recently-Announced Discounts

Our Daydreaming Designer Imagines A Cybertruck-Shaped Camper Trailer That Almost Makes Sense

Here’s What You Should Know About 2023’s EV Tax Credits For Used Cars

i put my southern maine zip in and it showed up as cars available for boston. there are 6 model Y’s available about $55-60k each and all have awd. there are 5 models 3’s total available and none of them are awd and all are about $44-47k. thats within 200 miles of me, which is the largest range they offer. they also say they have to be registered in Massachusetts. how does one from maine even get into one of these vehicles? i cant seem to find a new model 3 awd for sale.

While I am a sucker for a deal, I’m not interested in this deal.

So for the past year+, Teslas had OEM markup as opposed to dealer markups on other brands? Is that it?

Like the stock market eh? Dang I bought Amazon at 200 and now it is 150. Perhaps Tesla could work out some deal with Casinos

I don’t know if anyone at Tesla will read this, and I don’t think I should be handing out advice to multi-billion dollar corporations for free, but here: crate kits for EV conversion. It’s all the rage these days, and rather than fight the people who salvage wrecked Teslas, you could be in business with them. Seems like a no-brainer to me.

Also, getting rid of that Elon guy couldn’t hurt.

Tesla is production constrained, so any motors and batteries they manufacture means less cars they can sell. There are other companies that make EV crate motors and kits though, like EV West

But they’re not selling as many cars as they’d like, otherwise they wouldn’t be slashing prices overnight, so keeping production figures hardly makes sense. They’re just piling up inventory. They could throttle car production for a while and concentrate on a cheaper product to build that I think could be a serious sales hit, which they could then scale back again once there’s more demand for their cars.

I know other companies make EV crate kits, but Tesla could basically take the cake in that market, as they make the EV tech everyone wants (hence the scavenging for wrecked Tesla powertrains), and are big enough that they can price their crates competitively. I think ultimately it would be a way better way to adapt to market trends than panic-slashing prices.

Great

Is Tesla losing market share of US vehicles? Share of BEV sales is a less relevant metric. It’s easy to calculate and it gets clicks, but share of vehicle sales is $$, BEV percentage is important to the entire world and the industry, but Tesla share of BEV is driven by two movers and not picking that apart gives you a misleading value.

Some quick googling says they went from 2.2% in 2021 to 4% in 2022, which tracks pretty well with their sales increases. So, yes, quite a lot of fun with statistics on this one to claim they’re in imminent decline.

TSLA’s share of EV’s is relevant to how investors view them. Their stock price was super high not because of historical sales or profit, but because of what their sales and profit would be if they could maintain prices and keep a high (unreasonably high) share of EV sales. I’m not saying that this expectation was reasonable, but it’s clear they’re not keeping pace with overall EV growth enough to satisfy investors. Other, newer entrants are eating their cake. To me this seemed inevitable, especially with new competition, limited product launches/refreshes, and low (relative to “major” OEMs) production capacity. That it’s happening already means that TSLA is no longer synonymous with EVs they way their investors thought.

The stock price wasn’t driven by visions of reasonable growth, but of keeping 50%+ of EV market while the market grew to overtake ICE vehicles. I wouldn’t say TSLA the company is failing, but that irrationally unreasonable expectations are falling back down into merely wildly optimistic territory. The impact of the price drop is complicated by the fact that they raised prices frequently and supply is not quite as constrained (by things like chip shortages and COVID stops) as it had been. To me they get a pass on this until they have to do it again to keep their factories busy or if inventory begins to build.

Agreed. If you start out with 95% EV market share, and suddenly there are 30 other companies competing, you’re going to lose market share, there’s no way around it. But in the grander scheme of things when you’re competing against all vehicles, a 0.1% to 5% market share sort of change is much more valuable. And that’s what they’re going for. After all, Tesla’s mission statement is not “to be the best EV”, it’s “Accelerating the World’s Transition to Sustainable Energy”. And that they have succeeded at.

The company is in trouble and they know it. Because the honeymoon is over. Electric cars used to be exciting and new. They are becoming mainstream. And so people are less likely to be excited about a company that makes benign looking lozenge shaped cars that haven’t had a major design update in over a decade. Their CEO didn’t help either and soured many people when he started acting like an asshole and his awful takeover of Twitter. They still have time but they have got to get on it now. Get the cybertruck out. Yeah- it crazy looking and I don’t personally like it but its different and will get a lot of attention. The entire Model Lineup needs a serious styling overhaul to make it look fresh. And lastly? Getting rid of Elon would go a long way to heal people’s perceptions.

I guess the question is does tesla have stock to actually sell right now? and if not will the price stay firm after next week if you actually buy a car not yet built?

The question I have is if this price decline is in fact profitable, then why was the price so much more prior? How much are others getting raked over the coals here. I guess also how much did Elon get in the form of green credit dollars from the likes of GM/Dodge/Ford to offset emissions? and are those still a thing? I suppose if you wanted to clear out old inventory, could make money from a weird loophole that gets EV’s government subsidies and can sell them even cheaper to the customers without losing anything going into your pocket, then Maybe that is the plan here.

Getting carbon credits was pretty much their entire business model, as far as I can tell.

The price was higher because people were willing to pay it, and Tesla production couldn’t keep up with demand. Basically, the extra markups in 2021/2022 went to Tesla instead of dealers.

The carbon credits are still a thing, but apparently fluctuate a lot. First link I found googling said in Q1 2022 they actually increased and were responsible for ~20% of Tesla’s profit. So, they definitely help the company but Tesla’s no longer really reliant on them.